Last Updated on 1 year by Francis

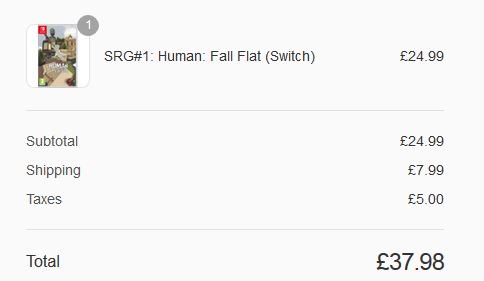

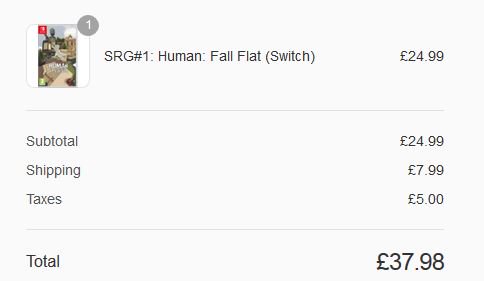

If you’re a savvy shopper, you know the importance of making sure you’re getting the best bang for your buck. Whether you’re buying online or in person, understanding the cost of goods and services, including taxes, is a key part of the equation. So, what is 24.99 with tax? In this article, we’ll explore what this figure means and how to calculate it in different situations.

Contents

What is 24.99 with Sales Tax?

The amount of 24.99 with sales tax is the total cost of an item including the sales tax rate. Sales tax is a type of tax levied by the government on certain goods and services. It is a percentage of the total cost of the item, and is based on the location of the buyer and seller. Knowing the amount of 24.99 with sales tax can help shoppers plan and budget for their purchases.

In order to calculate the amount of 24.99 with sales tax, shoppers must know the applicable sales tax rate for their location. This rate can vary from one state, county or city to another. Once the applicable rate is known, shoppers can calculate the amount of 24.99 with sales tax by multiplying the total cost of the item by the sales tax rate. For example, if the applicable sales tax rate is 5%, the amount of 24.99 with sales tax would be 26.2445.

How to Calculate 24.99 with Sales Tax

Calculating the amount of 24.99 with sales tax is relatively easy. All shoppers need to do is multiply the total cost of the item by the applicable sales tax rate. For example, if the applicable sales tax rate is 5%, shoppers must multiply 24.99 by .05 to find the amount of 24.99 with sales tax. This calculation would yield a total of 26.2445.

In addition to knowing the applicable sales tax rate, shoppers must also be aware of any other applicable taxes or fees that may be added to their total cost. Some locations may also have an additional local tax rate that must be taken into account. For example, if the local tax rate is 1%, shoppers must add this amount to the applicable sales tax rate to get the total amount of 24.99 with sales tax.

Understanding Sales Tax Rates

Sales tax rates are determined by the local, state and federal governments. The rate may vary depending on the type of goods or services purchased and the location of the buyer and seller. In some cases, the sales tax rate may also be affected by whether the transaction is conducted online or in-person.

It is important for shoppers to understand the applicable sales tax rate for their location in order to calculate the amount of 24.99 with sales tax. Sales tax rates can be found online, or by contacting the local or state government.

Online Resources for Sales Tax Rates

Shoppers can find the applicable sales tax rate for their location by using online resources such as the Tax Foundation or Avalara. These websites provide detailed information about sales tax rates for all states, counties and cities. In addition, shoppers can use the Sales Tax Calculator to quickly and easily calculate the amount of 24.99 with sales tax.

Conclusion

Knowing the amount of 24.99 with sales tax can help shoppers plan and budget for their purchases. In order to calculate the amount of 24.99 with sales tax, shoppers must know the applicable sales tax rate for their location. This rate can be found online or by contacting the local or state government. Once the applicable rate is known, shoppers can calculate the amount of 24.99 with sales tax by multiplying the total cost of the item by the sales tax rate.

Frequently Asked Questions

What is 24.99 With Tax?

Answer: 24.99 with tax is a price that includes the sales tax that is applicable in the area where the item is being purchased. Sales tax is typically a percentage of the total purchase price, and varies by state and locality. For example, in Illinois the sales tax rate is 6.25%, so 24.99 with tax would equal 26.69 after taxes have been applied. In California, the sales tax rate is 7.25%, so 24.99 with tax would equal 26.86 after taxes have been applied. It is important to consider the applicable sales tax rate when making purchases.

The answer to the question of what is 24.99 with tax is that it depends on the tax rate. In general, the price of 24.99 plus tax will be higher than 24.99 depending on the local tax rate. Knowing the exact price of an item with tax can help individuals and businesses budget and plan accordingly.